In the past few days, it sure feels like the mainstream media is setting us up for a market crash. Michael Snyder wrote about this the other day and he certainly seems on point:

Why Is The Mainstream Media Signaling That A Much Larger Stock Market Decline Is Coming?

Could it be possible that there will be an attempt to disrupt the market in an attempt to make one of the candidates look bad?

by Michael Snyder of The Economic Collapse Blog

Why would the mainstream media want all of us to believe that stock prices are about to fall dramatically? Just like we witnessed earlier this year at the beginning of the pandemic, the corporate media is full of reports that seem to imply that it is a virtual certainty that stock prices are going to go even lower. Of course it would make perfect sense for stock prices to go down because they are incredibly overvalued right now, but normally the mainstream media does not try to tell us where stock prices are going next. And the fact that so many news outlets are repeating the same mantra right now is particularly troublesome.

Unfortunately, market activity and media reports more than justify our warning from June 26th.

In regard to market activity, MarketWatch declared on Monday that this month may be the worst September in 18 years:

“Stocks on Monday were seemingly unraveling a bullish trend that now risks thrusting U.S. equity benchmarks into a bearish tilt that could set the stage for the worst September selloff in years for the major equity gauges.

With a decline of about 7.5%, the index is on track for its steepest decline in a September, since 2002, when it crumbled 11% in the month on the back of growing fears of inflating internet-related stocks, according to Dow Jones Market Data.”

Now think about that for a second. Predicting the worst September since 2002? What about September 2008, when Lehman failed and the entire market collapsed? That crash changed the course of America forever because an unknown first-term Senator (Obama) defeated a former POW revered Senator (McCain) in the race for the White House. Before the crash, McCain was leading in the polls. Even Biden himself admitted that if the market hadn’t crashed, McCain would have won. So, in the scheme of things, the 2008 market drop was pretty significant. But the media says this will be worse. USA Today warns that we are facing a looming “Financial Crisis.” CNBC writes that the stock selloff is “going to get worse…” [Interestingly, the same media predicting an American market crash is also pushing Chinese stocks.]

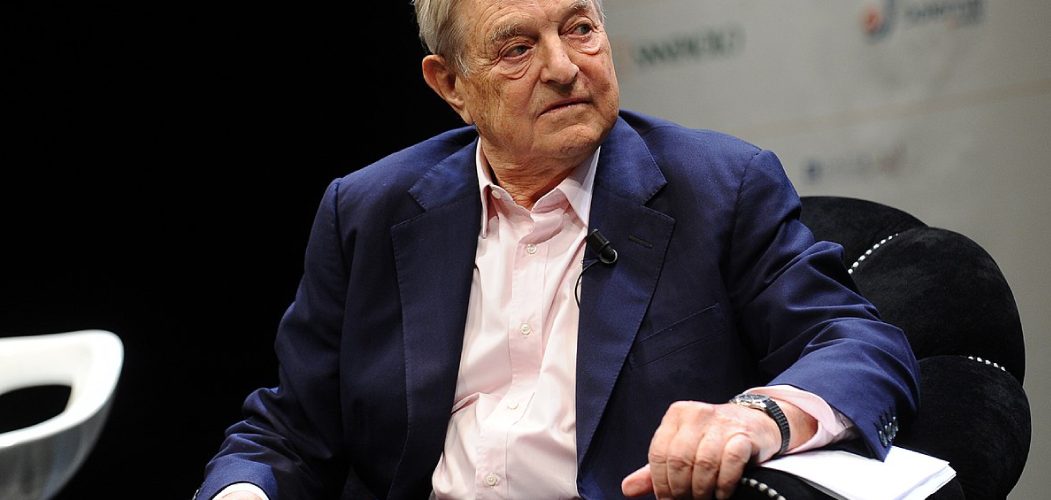

George Soros (once convicted of insider trading) explained what happened in 2008. He called the attacks on Lehman Brothers and other financial companies “Bear Raids.” We agree and covered all of that in detail both in my Pentagon report and book Secret Weapon: How Economic Terrorism Took Down the US Stock Market and Why It Could Happen Again. The fact that Soros agrees, however, is a really big deal. Bear Raids are bad because they are illegal market manipulation. Soros understands that. Perhaps that is why the Chinese authors of Unrestricted Warfare liken him to a “financial terrorist.” They did so after concluding that Soros used market manipulations to topple both currencies and countries.

Speaking of Unrestricted Warfare, the Chinese book also labels a “single manmade stock market crash” as one of their “new concept weapons.” We know that a market crash, rightly timed, can dramatically change a Presidential election. That has been proven repeatedly. And, we know that both Soros and the Chinese (separately) would much prefer seeing Trump out and Biden in. So what does that suggest for the stock market????

In January of this year, Soros came out publicly suggesting that an economic calamity and market collapse before the election might doom the Trump Presidency (from CNBC):

Liberal billionaire George Soros said Thursday that the U.S. economy could be headed for calamity as a result of President Donald Trump’s efforts to juice American business and stock prices ahead of the 2020 election….“The stock market, already celebrating Trump’s military success, is breaking out to reach new heights,” he said. “…If all this had happened closer to the elections, it would have assured his reelection…“His problem is that the elections are still 10 months away, and in a revolutionary situation, that is a lifetime,” Soros said.

The Boston Globe shared a similar sentiment on September 17th, suggesting that Trump would face the same fate as McCain did 12 years ago:

Early signs the bottom might be falling out on Trump in 2020, just as it did for McCain this same week in 2008

By James Pindell Globe Staff, Updated September 17, 2020, 3:37 p.m.

Since 2000, presidential elections have been won in the margins. Some wins were bigger than others. But compared to the previous century, this two-decade period of competitive elections is a testament to how polarized the country has become.

But there is one exception to the recent rule: Barack Obama’s landslide victory in 2008. In November, Obama stomped all over Republican John McCain. Obama took 68 percent of Electoral College votes by winning states like Indiana and Virginia that no Democrat had won since 1964.

For most of that year, the 2008 presidential campaign didn’t feel like a landslide at all. Indeed, in early September national polling from reputable outlets like the Associated Press, CBS News, and ABC News all had McCain ahead of Obama. A USA Today/Gallup poll had McCain up 10 points on Labor Day weekend.

But shortly after, the bottom fell out on McCain.

It was painfully obvious and he never recovered.

In the last 24 hours, the 2020 presidential race began to feel a lot 2008. A series of new polls imply the bottom might be falling out on Republicans again, especially for President Trump….

It was during this same week in 2008 that the once-vaunted Lehman Brothers collapsed. The pain of the Great Recession followed. Republicans were in power and got blamed, and McCain was criticized for how he didn’t project leadership and have a plan.

Sounds like the Boston Globe is also counting on a market disaster to doom President Trump in a repeat of 2008. Imagine that.

What Can Be Done About It?

Here’s something interesting from 2009. Soros got his wish with Obama in the White House (following a market crash). But afterward, he admitted that a Bear Raid made the crash happen. At that point, he actually endorsed putting back the “uptick rule” to stop further manipulation:

Maybe Soros just wanted to make certain that the “new concept weapon” of a bear raid market crash wouldn’t be used to unseat Obama? After all, he (like everyone else on the left) assumed that, barring a market crash, Obama would automatically win a second term (followed by two terms for Hillary Clinton). To be on the safe side, however, perhaps it was better to eliminate the wild card of bear raids. Regardless of his motive, Soros was right. We should restore the Uptick Rule! And we should eliminate manipulative naked short selling.

This is what we said in June:

In 1937, the newly formed Securities and Exchange Commission (SEC) under the direction of Joe Kennedy instituted the first Uptick Rule. The Uptick Rule requires short sales to be conducted at a higher price than the previous trade. It remained in place until 2007, when the SEC ran a flawed 6-month study suggesting the rule had little impact. There are academic studies disputing the (flawed) findings. Nevertheless, the rule was removed in 2007, just prior to the worst market decline since 1937. The traditional uptick rule’s removal allowed for High-Frequency Trading to take control of markets. The SEC adopted a “new uptick rule” but it is not nearly as effective. Many on Wall Street (who profit from HFT) will vehemently oppose putting back the old rule. But Jim Cramer has supported it, and billionaire hedge fund manager Leon Cooperman actively promotes its return. Charles Schwab also recommended its return. Putting it in place would certainly throttle destabilization plans.

Recommended Action: POTUS should direct the SEC to immediately adopt a measure allowing for the reinstitution of the traditional uptick rule. This could prevent malicious manipulation or control of High Frequency Trading designed to cause a market crash. The SEC should also require than any share sold short must first be borrowed. No naked shorting allowed.

All of this applies today and has become even more urgent as the media salivates over current market weakness. But now, we have another endorsement for what we’ve been saying. We have (2009) George Soros in agreement!

It’s not too late (yet) but Urgent Action is required NOW!