“Blockchain platforms have the potential to give individuals a way to prove our identities, establish our personal networks, and buy and sell. We would then control access to that information, rather than surrender it to Facebook, banks, and Amazon.”

The blockchain technology that created Bitcoin, Ethereum, and crypto-currencies may be more important than the currencies themselves. It may change the nature of the internet, and restore the balance of power to individuals.

Bitcoin made news by losing half its value this week. This actually is a promising sign for digital currencies, because a crash is better than an evaporation. It proves that crypto-currencies will not disappear, but will stabilize at a new, more rational level.

Inflated, But Not A Bubble

I have written disparagingly of digital currencies in the past, comparing them to the Dutch tulip craze of the 16th century. I was wrong. It is clear that they fill a set of needs in the internet age. As long as those needs persist, so will the demand for digital currencies.

It is true that the wild climb in pricing is a result of unsophisticated investors flocking to the new currencies just as pre-programmed scarcity decreases the quantity supplied. But there is a clear and strong level of price support in the exchange pricing. Had Bitcoin been like tulip bulbs, a 50% plunge would have ended it. Instead, there has been a strong rally.

The plunge is easily explained. China and South Korea, two countries where Bitcoin is popular, both expressed regulatory urges in recent days. China outlawed virtual currencies last year, and just announced an intention to shut down sites that continue to trade the currencies.

The real promise of these new technologies lies not in displacing our currencies but in replacing much of what we now think of as the internet.

China’s announcement came shortly after South Korea’s Minister of Justice warned that his government is planning to crack down on virtual currency exchanges. South Korea hosts the third largest crypto-currency market in the world, behind Japan and the United States. Korea’s blockchain trade association estimates that there are over a dozen exchanges in the country.

As Korean consumers have joined data specialists and professional traders in a rush to enter the market, their government is concerned that the volatility could affect conventional markets. The minister expressed a fear of irrational buying behavior, amid worries that the ‘investments’ looked more like gambling. South Korea is a tech-heavy society, and many young people see Bitcoin mining and trading as a possible way to make money.

Digital Gold: A Store of Value

Nathaniel Popper writes about digital currencies in the New York Times. He titled his 2015 book Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money. The title is a reflection of the view taken by many investors that digital currency is a new store of value.

… having to break into every house in the village rather than just robbing the bank.

Traditional investors are coming to share that view. Peter Thiel said in October 2017 that the currency is undervalued, and compared it to gold as a store of value. He revealed early in 2018 that his venture capital firm, Founders Fund, has invested hundreds of millions of dollars in Bitcoin in the past year. He called it “unhackable.”

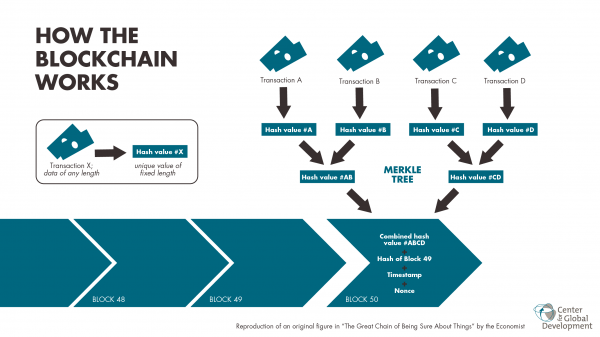

Steven Johnson wrote something similar yesterday in the New York Times Magazine. He pointed out that one strength of virtual currencies is that their value is spread out among millions of computers worldwide. In order to steal someone’s stash of Bitcoin or Ether (the Ethereum version of digital currency), a thief would have to hack millions of computers and steal the tiny bits of data from each one.

It’s much more work, for much less money, than hacking into Equifax and stealing millions of credit cards from one server. Johnson compares it to having to break into every house in the village rather than just robbing the bank. In fact, he points out, in the nine years of Bitcoin’s existence and in spite of the many billions of dollars in value, there has not been a single instance of digital theft of the asset.

Blockchain Technology May Restore the Open Internet

Johnson goes much further in his praise of the technology on which digital currencies are based – blockchain platforms. He makes a strong case for their potential to restore the open, communal nature of the internet. “If Tim Berners-Lee, the inventor of the World Wide Web, had included a protocol for mapping our social identity in his original specs, we might not have Facebook. The true believers behind blockchain platforms like Ethereum argue that a network of distributed trust is one of those advances in software architecture that will prove, in the long run, to have historic significance.”

… blockchain technology could restore the internet to its roots as an open communal platform, and restore control of our identity and friendships to us.

This significance may outlive Bitcoin itself. “The real promise of these new technologies, many of their evangelists believe, lies not in displacing our currencies but in replacing much of what we now think of as the internet, while at the same time returning the online world to a more decentralized and egalitarian system.”

The digital titans, Amazon, Facebook, Google and Twitter, found an open infrastructure for sharing information that left out a key element. There was nothing to prove a user’s identity, or link it to the user’s tastes, preferences, personal networks, and personal history. The new titans supplied the identity and linkages, and closed off their technology in order to maximize corporate profit. They lend us tiny amounts of space on their servers for us to upload our personal information, which they sell repeatedly.

Blockchain platforms have the potential to give individuals a way to prove our identities, establish our personal networks, and buy and sell. We would then control access to that information, rather than surrender it to Facebook, banks, and Amazon.

As you pay attention to the swings, highs and lows of Bitcoin, Ether, and other crypto-currencies, learn to understand the blockchain technology that makes them possible. It could restore the internet to its roots as an open communal platform, and restore control of our identity and friendships to us.