I know some citizens are still on the fence regarding decriminalizing cannabis, but the higher percentage is proponent. Quinnipiac University conducted a national poll and found “Voters also support [legalizing cannabis] 94 – 5 percent ‘allowing adults to legally use marijuana for medical purposes if their doctor prescribes it.'”

With the US House passing the Tax Cuts and Jobs Act on November 16, 2017 it would seem logical to bolster our budget-burdened nation by refilling the pot with steady revenue growth. Legalized cannabis crops can rake in taxes in excess of $10 billion per year, according to Cannabis Tax Act estimates. Still other estimates claim there is plenty of scratch to me made from seeds.

TaxFoundation.org purports “A mature marijuana industry could generate up to $28 billion in tax revenues for federal, state, and local governments, including $7 billion in federal revenue” and that “a federal tax of $23 per pound of product, similar to the federal tax on tobacco, could generate $500 million per year. Alternatively, a 10 percent sales surtax could generate $5.3 billion per year, with higher tax rates collecting proportionately more.” Cha-ching, indeed.

Some governments with state taxation codes sought to generate revenue from the all-natural, legal dispensation of cannabis. Oregon, for example, implemented their Cannabis Tax Act after Oregon Ballot Measure 91 greenlighted marijuana dispensary sales. Cannabis sales are subject to taxation codes and transactions are regulated by the Oregon Liquor Control Commission.

In 2015, Oregon “State officials began working on establishing a regulatory structure for sales of marijuana, and taxing of such sales, with the Oregon Liquor Control Commission (OLCC) to oversee it. Effective January 1, 2017, dispensaries were no longer permitted to sell cannabis for recreational use unless they applied for, and received, an OLCC license for such sales.” That state-issued license comes with a fee, also buffering state revenue coffers.

According to FindLaw.com, “Oregon became the third state in the U.S. to legalize the recreational use of marijuana by adults when voters approved Measure 91 during the 2014 general election. As of July 1, 2015, adults 21 and over are allowed to grow up to four plants and have up to eight ounces of useable marijuana for personal use. Recreational sales [were] limited to existing medical marijuana dispensaries until more robust regulations [were] implemented in 2016.”

In addition to sales tax on cannabis dispensation, the Oregon Medical Marijuana Act also contains language stipulating medicinal use cardholders and/or their caregivers must pay a fee for the card so as to regulate legitimate patient/marijuana merchant transactions. The Oregon Department of Human Services receives such fees before issuing “registry identification cards to approved persons with debilitating condition.”

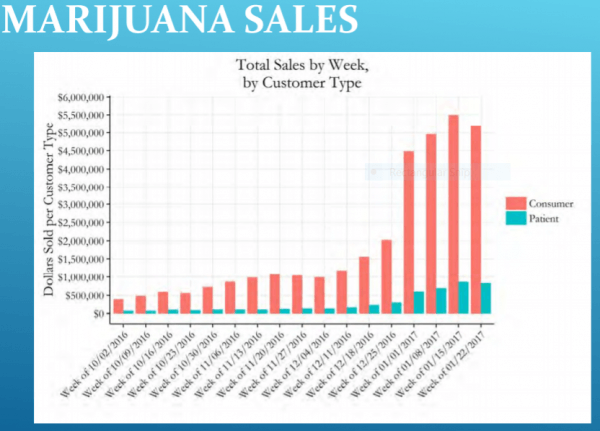

The Oregon Department of Revenue published tax tables in which a steady increase in cannabis taxation is evident. In July 2017, the most current month for which tax figures are available, Oregon collected a combined state/local tax revenue of $5,944,069. Defines “seed money” in a whole new light, doesn’t it? And Oregon’s medical marijuana taxation is a mere microcosm of what federal taxation revenues may garner, thereby releasing pressure from an already gargantuan national budget deficit.

Oregon’s medical marijuana taxation is a mere microcosm of what federal taxation revenues may garner, thereby releasing pressure from an already gargantuan national budget deficit.

Exponential View

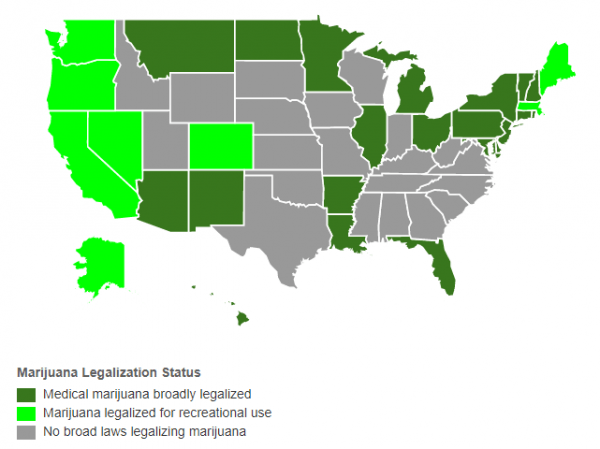

We just analyzed Oregon’s model of state taxation regarding their cannabis industry cultivation. Broadening the scope, there are currently 30 states, and the US territories of Guam and Puerto Rico, with cannabis legislation to permit some form of sanctioned use, the National Conference of State Legislators reported in September 2017.

According to Governing.com, “Twenty-nine states and the District of Columbia currently have laws broadly legalizing marijuana in some form.” California among them, “Prop. 64 measure allows adults 21 and older to possess up to one ounce of marijuana and grow up to six plants in their homes. Other tax and licensing provisions of the law will not take effect until January 2018.” The tax ball is rolling in state governments recognizing marijuana as a cash crop.

September 2017 status of states encompassing some form of cannabis legalization. (Credit: Governing.com)

Among those state governments, Massachusetts posed an intriguing (alarming) tax-based venture. MassLive.com reported “Taxes on marijuana would hit to 28 percent under the bill Massachusetts House lawmakers plan to propose and take up this week [June 2017]. A legalization advocacy group called the tax hike ‘irrational’ and a boost to the black market.”

Jim Borghesani, spokesman for “Yes on 4,” a group advocating yet monitoring Massachusetts marijuana legislation, implied back-door modifications are afoot in legislative chambers: “Its irrational tax increase will give drug dealers the ability to undercut the legal market, and its removal of ban authority from local voters will give a handful of selectmen the ability to overrule the opinion of their own constituents.” I wonder how Shark Tank investors would reason a 28 percent tax for starters.

About the Centennial State, a MarketWatch report indicated “The state of Colorado pulled in nearly $200 million in tax revenue [in 2016] thanks to its $1.3 billion in marijuana revenue.”

According to Mason Tvert, communications director for Denver’s Marijuana Policy Project, “This money is just the tip of the iceberg. Hopefully this will be a wake-up call for the [remaining] states that still choose to force marijuana sales into the criminal market and forego millions of dollars in tax revenue. The state received nearly $200 million in marijuana tax revenue, whereas just a decade ago it was receiving zero.”

“The state received nearly $200 million in marijuana tax revenue, whereas just a decade ago it was receiving zero.”

Considered the state which pioneered cannabis legalization, Colorado serves as perhaps the best litmus test pertaining to state governments eyeing tax revenues from weed sales.

Quasi-Medical School

I happen to have a medical doctor in my family who is studying medical board-specified material necessary to attain authorization from the Florida Department of Health to legally recommend/prescribe medical marijuana for patients. Each physician pays a course/exam fee so as to be a “certified practitioner” listed among the state registry of medical marijuana practitioners. That fee is also revenue which goes to the state, so the proceeds supplement any taxes collected.

Each physician pays a course/exam fee so as to be a “certified practitioner” listed among the state registry of medical marijuana practitioners. That fee is also revenue which goes to the state, so the proceeds supplement any taxes collected.

Under my wing, I have a particular patient in dire need of an ostensibly novel intervention which could viably come from medical cannabis strains.

Personal Stake

Notwithstanding a police career under my belt, I have a personal stake in medical marijuana, specifically the strain which may quell an autistic child’s self-injurious behavior. From chronically researching all-things-weed, I have honed in on a Florida state-licensed medical doctor (pediatrician specializing in autistic children) who is authorized by the Department of Health to recommend/prescribe medical marijuana.

As a former policeman who arrested an infinite number of “weeders,” do I ponder the seeming hypocrisy? Indeed I do. The personal stake I have in my child, however, is paramount and supported by research studies imploring cannabis as a holistic remedy. Legalization of medical marijuana is like swimming with the tides, not against. I continue to tweak my professional/personal conflicts. As I do I recognize any awkwardness I may harbor about marijuana is far supplanted by the deep conflict endured by my severely autistic offspring.

In that regard, I support the change in laws. I also have no qualms about taxation, within reason. I possess no reservations of what it looks like, as long as my afflicted daughter achieves a throttled reverse of the inexplicable nature of self-harm stemming from intense autism and its comorbidities. Strikingly, traumatic brain injury (TBI) is a tremendous concern, despite headgear and Posey mitts absorbing the blows for almost ten years.

A Texas dad and his autistic daughter whose story is closely compatible with our situation can be viewed here. The Cannabis Capitol “Patient Chronicles” on YouTube also exposes the benefits of medical marijuana for autistics, as depicted here.

Naloxone (“Narcan”), the drug used by cops to pull opioid addicts from the brink of overdosing, also has a small percentage of known cases whereby the drug’s use on non-verbal autistics miraculously enabled speech in some children. My child has naloxone in her prescription formulary. Although it is intended to treat her self-injurious behaviors (SIBs), the potential for speech to evolve from a non-verbal almost-18-year-old would be beyond a breakthrough. Coupled with medical marijuana, hope is preserved.

Big Pharma Karma

I have no problem flipping-off Big Pharma and their chemical wares versus the organic nature of cannabis. There is mounting material that medical marijuana and holistic relief provided to pained patients is a boon for weed cultivators and a potential death knell for Big Pharma’s cadre of chemists.

Another medical marijuana aspect with a curious tax twist was exposed by US News and World Reports (January 2016) whereby research data produced by the journal Health Affairs indicate “doctors are prescribing medical marijuana in place of medications that have been typically used to treat patients for disorders like pain, seizures, sleep disorders, depression and anxiety. The swap appears to have saved the Medicare program – whose patients include seniors and people with disabilities – $104.5 million in 2010 and $165.2 million [in] 2013, because doctors are prescribing other drugs less.”

Therein is a two-way tax street many can cross without getting flattened by the Big Pharma bus. “Pharma Bro” Martin Shkreli anyone?

Tugging on Hemp

Marijuana is still unlawful as far as the feds are concerned. Even though state laws are now on the books whereby cannabis is either legalized for recreational and/or medicinal use, the federal government has not given the green light but continues to wave away the smoke before retreating to the bleachers.

US Attorney General Jeff Sessions once said: “Good people don’t smoke marijuana.”

In recent congressional hearings during which USAG Jeff Sessions was roasted for five hours, the subject of cannabis came up. Although unambiguous in his anti-green feelings about the existence of marijuana, AG Sessions conceded that “budget riders” preclude Department of Justice prosecutors and federal agents from going after those in states with marijuana laws allowing medicinal use.

“Federal law remains in effect and a state can legalize marijuana for its law enforcement purposes but it still remains illegal with regard to federal purposes.”

Referring to the Obama administration, Mr. Sessions said, “Our policy is the same, really, fundamentally as the Holder-Lynch policy, which is that the federal law remains in effect and a state can legalize marijuana for its law enforcement purposes but it still remains illegal with regard to federal purposes.” The word “compliance” relating to medical marijuana permissions in states is a common denominator regarding DoJ’s stance. Implicitly, as long as a user has a bona fide medical marijuana card and its jurisdictional stipulations are abided, federal interference is unlikely.

“Under current federal law, [marijuana is] classified under Schedule I of the Controlled Substances Act, a category that’s supposed to be reserved for drugs with a high potential for abuse and no medical value,” reported Forbes.com.

“The [marijuana cultivation] industry is on edge, however, because of the uncertainty about how President Donald Trump and a Jeff Sessions-led Justice Department will approach regulation and enforcement,” MarketWatch reported. Interestingly, the DC Capitol is among US territories with medical marijuana laws in effect, so it is right under (in) federal noses.

Is there a twisted irony in that significant revenue from taxing cannabis could be the cash cow needed to fix the DoJ “budget riders” implicitly ill-affording federal enforcement of marijuana use across America? What do you think marijuana taxation can do for our nation’s budget burdens?

Will revenues from cash-crop cannabis smoke Big Pharma profits away like citronella torches repel pesky blood-sucking critters?

Are we as a nation getting steps closer to evergreen? Will revenues from cash-crop cannabis smoke Big Pharma profits away like citronella torches repel pesky blood-sucking critters? Will vibrant tax drawers of cannabis-regulated states be enough impetus for the federal government to consider the organic boon? Will states’ tax revenues continue to graciously go up…in smoke?

These and other queries give us something to, you know…munch on over the week.