Please Follow us on Gab, Parler, Minds, Telegram

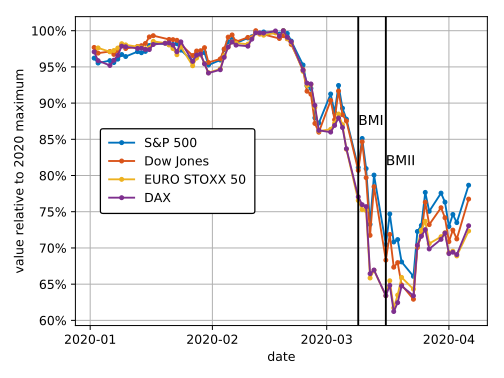

Financial markets have been roiled recently with epic short squeezes, brought on by retail investors ‘Robinhoodrs’ causing extreme volatility via short-term trading. Institutional investors don’t like this development one bit and are pressuring the SEC to limit individual investor access to the financial markets.

Dan David, founder of Wolfpack Research, explains why the short of Game Stop represents a bigger picture of failed monetary policy in the U.S., reported War Room Pandemic this morning

The political establishment is mad about the wrong people playing in the stock market, and more regulations are coming. David, one of the legendary shorts in China, says his sources tell him the Securities Exchange Commission is gearing up to limit the ability of individual investors in the market.

“They’re going to start regulating against the individual investors,” David said. “I know for a fact the SEC is discussing it right now. I wouldn’t be surprised if [Jerome] Powell spoke on it today.”

After the internet bubble burst at the turn of the century, increased regulation began to prevent individual investors from speculating without a certain level of capital. These types of ‘regulations’ will likely be increased.