“American taxpayers are expected to tell the truth regarding their tax preparations, and IRS leadership is subjected to the same expectations of integrity.”

In the spirit of tax season, I found it intriguing that Congressman Jason Chaffetz (R – UT) has garnered 38 other elected officials in joining his signature effort to compel President Donald Trump to remove Commissioner John Koskinen from the helm of the Internal Revenue Service (IRS). Whether or not a refund is on your tax menu this year, I suspect many can take solace knowing that Mr. Koskinen may be booted from the federal throne from which he reigned over the IRS Tea Party Targeting Scandal.

As chairman of the House Oversight and Government Reform Committee, Congressman Chaffetz fired a shot across the bow of Mr. Koskinen with intent to have him dislodged from office, saying, “The most powerful and feared agency Americans interact with is the Internal Revenue Service, and it is currently run by a commissioner who testified falsely and obstructed a congressional investigation.” That significant paragraph was spelled out in the letter’s opening, getting right to the core of the matter. With signatures added to bolster the letter’s intent, 38 other Republicans stand behind those assertive words authored by Congressman Chaffetz. Can you blame them?

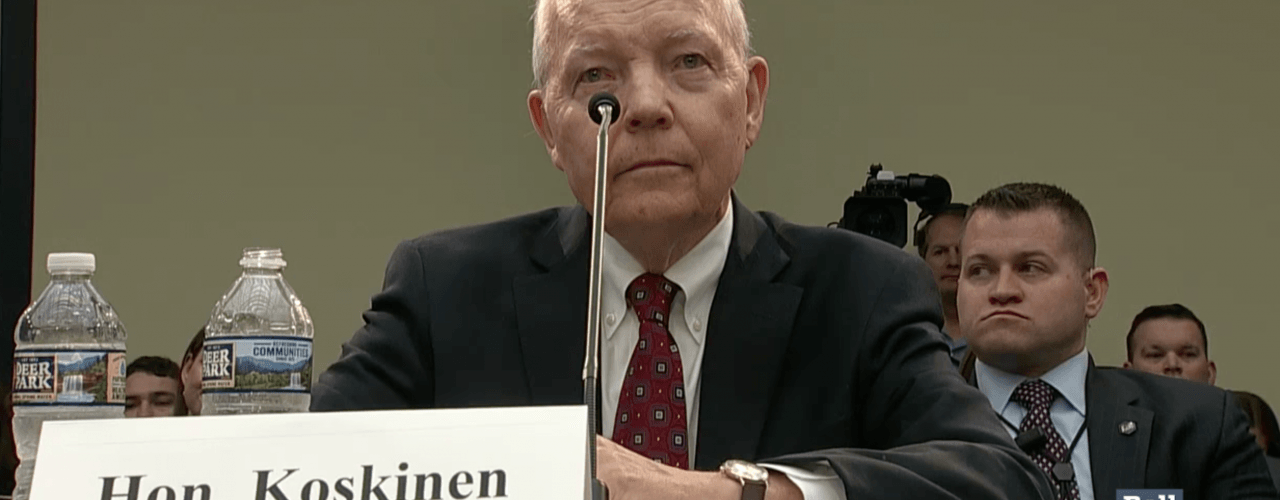

Hours of his testimony before the US Congress regarding the IRS Tea Party Targeting Scandal (involving cohort Lois Lerner) portrayed a rather cocky and arrogant IRS commissioner toying with the elected panel and skirting questions. With the embattled IRS in the crosshairs of politicos submitting inquiries, Koskinen seemed amused by the attention and pushed back efforts without committing to any concrete details. Nevertheless, Koskinen was determined. So were members of Congress. Ultimately, elected officials deemed that Koskinen tendered “false testimony” and “obstructed” a congressional investigation, disgracing his position as the head of tax collection on behalf of America.

Congressman Chaffetz’s letter seeks to dethrone Mr. Koskinen once and for all. It seems others are joining his efforts to that end.

In May 2016, Republicans scheduled impeachment hearings, expecting Mr. Koskinen to appear and testify. He declined, citing he welcomed appearing before Congress but was not given enough time to adequately prepare. He had just returned from a global circuit, meeting with over 40 tax leaders from varying nations, and one full week was not sufficient before convening. Too taxing to simply show up and tell the truth? Or is strategizing and molding a defense case necessary because of all the allegations against the seemingly sinister IRS activities?

On April 5, 2017, the US House Ways and Means Committee submitted its own letter demanding President Trump terminate John Koskinen as head of the IRS, citing the same principal reasons as those submitted by the House Oversight and Government Reform Committee.

Does any of the IRS Targeting Scandal impact you at all? Perhaps not, but the IRS is being led by a man who many feel lied under oath—an oath similar to the one you endorse after you read (or at least skim) the criminal penalties in the event you submit your tax return knowing it contains total falsities and/or misrepresentations. It dictates as follows:

“Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and accurately list all amounts and sources of income I received during the tax year. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.”

In the event a citizen is nabbed for such a violation of federal law, the fine folks at the IRS are prepared to pounce. So, does it impact you? In the context of fairness, it does. American taxpayers are expected to tell the truth regarding their tax preparations, and IRS leadership is subjected to the same expectations of integrity. Seems there may be a double standard in play: what’s good for one is good for the other. Do as I say and not as I do?

If one decided to toy with the IRS and submit phony claims, if detected, one would be arrested. So why should Mr. Koskinen be immune from the very laws with which he failed to abide and uphold?

A graduate of Yale University, Duke University, University of Cambridge (UK), and Yale Law School, it appears Mr. Koskinen may have optimized the breadth of his Ivy League education to forestall the investigative efforts of the US Congress. It also appears the man of Finnish descent may be finished as the tax man.

Frankly, Americans ought to be confident in the IRS’ “ability to fairly administer the tax code,” as mentioned in the letter by the House Ways and Means Committee. For all the dubious activities, for all the apparent obfuscations, for all his bemusements while being interrogated by US Congress, Koskinen distanced himself and disavowed any IRS responsibility, pointedly spewing, “I don’t think an apology is owed.” At the heart of these letters is the focus of unmitigated broken trust facilitated by the IRS under the leadership of Mr. Koskinen with Lois Lerner in tow.

As it relates to Lois Lerner’s testimony and stonewalling attempts to get to the truth, Congressman Trey Gowdy laid it out for all when he detailed how constitutional rights go both ways; Ms. Lerner, an attorney, pleaded the Fifth and exercised her rights against self-incrimination while members of Congress (representing Americans) reserve the right to cross-examine her while under the legitimate scope of fact-finding.

And where’d that “I plead the Fifth” lady go after she declared herself an exemption and merely walked away scot-free? And lest we forget, former President Obama was the one who, in the face of the accusations by conservatives, publicly declared there’s “not even a smidgeon of corruption” at the IRS. Yet here we are, seeking to finally terminate John Koskinen and reopen investigations into the sordid practices of the IRS. The fire still burns, still pollutes the air, and fact-seekers are determined to extinguish the still-smoldering IRS malfeasance.

Attorney General Jeff Sessions has a letter from Congress on his desk asking for another look at the IRS Tea Party Targeting Scandal, alluding to new smoking gun information that engenders criminal prosecution, justly placing Lois Lerner in the crosshairs.

The letter from Congressmen Kevin Brady (Chairman, Ways and Means Committee) and Peter Roskam (Chairman, Subcommittee on Tax Policy) to Attorney General Jeff Sessions stipulated the following assertion: “It is clear that when the DOJ [Attorney General Eric Holder] announced in October 2015 that it would not bring charges against Lois Lerner, the agency was following President Obama’s signal on how he wanted the investigation to be handled.”

Admittedly, all these revelations took the sting out of filing my tax returns this year. (I hope I didn’t just add myself to some clandestine list of “targets” held by the dubious leadership of the IRS.)

Will members of varying Congressional committees demanding IRS Commissioner John Koskinen be fired also get their wish of having Lois Lerner criminally prosecuted? Wouldn’t that make for a pleasant “tax reform” measure?